Metropolitan Family Services FY24 Financials

STATEMENT OF ACTIVITIES

Years Ended June 30, 2024 and 2023

Amounts in 000’s

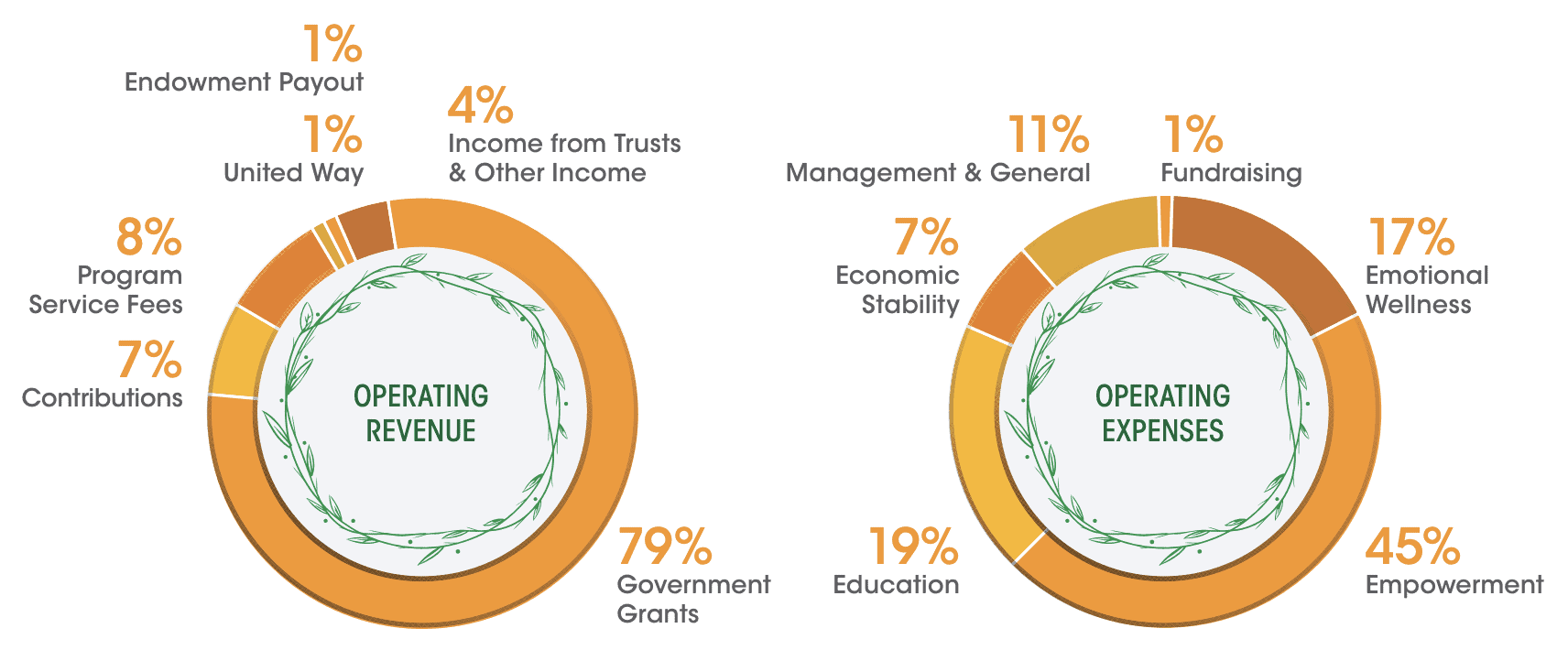

| OPERATING REVENUE | 2024 | 2023 |

| Government Grants | 120,918 | 99,244 |

| Program Service Fees | 12,775 | 11,146 |

| Contributions | 11,126 | 12,368 |

| United Way | 1,266 | 1,381 |

| Endowment Payout | 1,668 | 1,668 |

| Income from Trusts & Other Income | 6,132 | 3,958 |

| TOTAL OPERATING REVENUE | 153,885 | 129,765 |

| OPERATING EXPENSES PROGRAM EXPENSES | 2024 | 2023 |

| Empowerment | 68,921 | 51,769 |

| Education | 28,421 | 25,982 |

| Emotional Wellness | 26,827 | 26,482 |

| Economic Stability | 10,817 | 9,161 |

| Total Program Expenses | 134,986 | 113,394 |

| Management & General | 16,543 | 13,860 |

| Fund Raising | 2,236 | 2,153 |

| TOTAL OPERATING EXPENSES | 153,765 | 129,407 |

| OPERATING SURPLUS | 120 | 358 |

| OTHER CHANGES IN NET ASSETS | 2024 | 2023 |

| Depreciation & Amortization | (1,739) | (1,218) |

| Net Investment Gains | 2,186 | 2,663 |

| Change in Pension Liability | 69 | 594 |

| Change in Interest Rate Swap | 281 | 778 |

| Inherent Contribution of HACC | 0 | 3,279 |

| Transfer of Assets of I-Grow Chicago | 0 | (2,748) |

| ERC | 4,545 | |

| Capital Grants | 1,800 | 2,175 |

| Change in Restricted Contributions | (1,580) | 1,243 |

| NON OPERATING ACTIVITY | 5,562 | 6,766 |

| TOTAL CHANGE IN NET ASSETS | 5,682 | 7,124 |

| NET ASSETS AT BEGINNING OF YEAR | 85,531 | 78,407 |

| NET ASSETS AT END OF YEAR | 91,213 | 85,531 |

| In-Kind Contributions of Goods and Services | 4,302 | 4,236 |

BREAKDOWN OF EXPENSES

FY24

STATEMENT OF FINANCIAL POSITION

June 30, 2024 and 2023

Amounts in 000’s

| ASSETS | 2024 | 2023 |

| Cash | 8,922 | 15,324 |

| Receivables | 31,144 | 27,946 |

| Investments | 35,942 | 44,259 |

| Interest in Trusts | 18,560 | 17,231 |

| Property and Equipment | 33,420 | 31,690 |

| Lease Asset | 11,245 | 8,783 |

| Other | 2,146 | 1,497 |

| TOTAL ASSETS | 141,379 | 146,730 |

| LIABILITIES AND NET ASSETS | 2024 | 2023 |

| Accounts payable and Accruals | 14,545 | 13,086 |

| Investment Bond | 8,500 | 8,500 |

| New Markets Tax Credits Notes | 10,420 | 10,368 |

| Bonds Payable | 0 | 12,700 |

| Lease Liability | 11,734 | 9,248 |

| Other | 4,967 | 7,296 |

| TOTAL LIABILITIES | 50,166 | 61,198 |

| NET ASSETS | 91,213 | 85,532 |

| TOTAL LIABILITIES AND NET ASSETS | 141,379 | 146,730 |